Lately there has been renewed excitement and interest around stablecoins. This is partly due to some recent developments, including but not limited to:

a crypto-friendly incoming administrative regime here in the United States as well as potentially clarifying legislation like FIT21

new issuance and adoption of stablecoins by large incumbent fintech players like PayPal’s PyUSD

payment processor Stripe’s recent $1B+ acquisition of stablecoin infrastructure company Bridge and Y Combinator’s recently expanded request for startups adding stablecoin finance as an area of interest

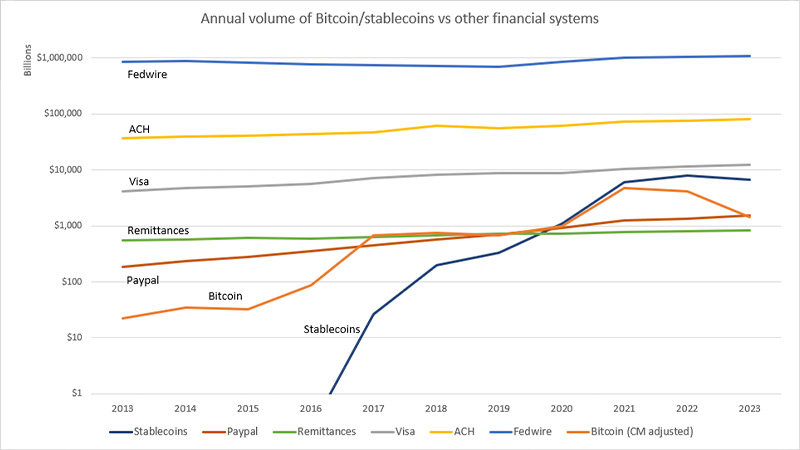

major card networks publicly announcing plans to support their own stablecoin platforms targeting financial institutions as well as publishing data on how stablecoins are catching up to their network settlement volumes:

Unlike traditional cryptocurrencies and digital assets, stablecoins maintain a stable value relative to a specific asset, basket of assets, or algorithm. Popular crypto assets like Bitcoin (BTC) and Ethereum (ETH) are known to be extremely volatile. Price volatility means more risk and added risk makes a poor case for usage as a payment method (or any other practical use cases). This is obvious to everyone who has worked with or holds crypto assets. But can stablecoins reduce this risk and pave a path for crypto assets as better payment methods vs current payment systems? The answer, at least on the surface, appears to be yes.

1-year vs 5-year Volatility Comparisons for Tether (USDT), EUR/USD, Bitcoin (BTC), and Ethereum (ETH)

Because low volatility is a key characteristic of stablecoins, in theory they are better suited for use cases such as payments, store of value, international remittances and, arguably, any other important mainstream uses. To illustrate this here’s a comparison of 1-year and 5-year volatility for Tether (USDT), EUR/USD, Bitcoin (BTC), and Ethereum (ETH).

Data: Yahoo Finance API at time of writing.

Based on this, USDT (Tether) has the lowest volatility among the assets compared and, as we will see later, other fiat-based stablecoins similarly tend to have low volatility. EUR/USD has relatively low volatility compared to Bitcoin (BTC) and Ethereum (ETH) but is still higher than USDT. Not surprisingly, Bitcoin (BTC) and Ethereum (ETH) have the highest volatility among the assets compared. This is not an exhaustive comparison obviously, but it provides a good idea of the volatility of the different assets over time.

There are four main types of stablecoins:

- Fiat-backed: Backed by fiat currencies like the US Dollar (USD) or the Euro (EUR). For example, USDC (USD Coin).

- Crypto-collateralized: Backed by cryptocurrencies like Ethereum (ETH) or Bitcoin (BTC); examples include DAI (from above) and sUSD (Synthetix USD).

- Algorithmic: Backed by any collateral but use algorithms to maintain stability; examples include USDD (Frax).

- Commodity-backed and Hybrid:

Commodity: Pegged to tangible assets like gold or silver; examples include PAXG (Paxos Gold) and DGX (Digix Gold).

Hybrid: PayPal’s PYUSD and Tether’s USDT are examples of hybrid stablecoins that are backed by a mix of fiat, US Treasuries, and other cash equivalents. This direction is likely to become more popular in the future imho.

1-Year vs 5-Year Maximum Deviations from Peg Value by Type

Data: Yahoo Finance API at time of writing.

The chart above shows the maximum deviation from the peg value of $1 US Dollar for different types of stablecoins over 1-year and 5-year periods. Fiat-backed stablecoins like USDT have the lowest deviation from the peg value, followed by crypto-collateralized stablecoins like DAI and algorithmic stablecoins like USDD. This is not an exhaustive comparison of stablecoins, but it provides a good idea of the stability of different types of stablecoins over time.

Stablecoin Future

Stablecoins work as expected and solve for volatility in straightforward and effective ways**. Fiat/commodity/hybrid backed stablecoins are here to stay and will play a significant role in the future of finance (at least I believe this is likely to be the case). Based on the usage data however, it does seem like adoption is still low and fragmentation will continue to be a challenge e.g. many chains, networks, interoperability, etc. The future of stablecoins will depend on how crypto engineers and the underlying connectivity infrastructure evolves, how regulators respond, and how the market matures with the support of large incumbents including banks, payment processors, and fintech companies. The future of stablecoins is bright, but it is still early days.

A16z also recently published a great post on understanding stablecoins through a banking history lens that is worth a read.

**Yes, there is some discussion around the systemic risks of stablecoins and the potential for “stablecoin runs”. A topic for another day.

DISCLAIMER: This is not financial advice and is for educational purposes only. Please send me corrections, comments and feedback.